Best Credit Repair Software and Service Providers

Best Personal Credit Repair Software or Services in 2021

Do you have a bad credit history to your name that you want to fix? If yes, it makes you one of those millions of people suffering from this issue. Many people have faced identity theft that has ruined their credit and lots have made bad financial decisions. However, it’s not something you can’t fix. You could either sign up for credit repair software and try to do it yourself or hire a credit repair company.

There are several ways to repair bad credit on your own or have it repaired at the hands of a credit repair service. Credit repair software is also available, enabling you to correct errors and false information in your credit reports.

If you’re looking to find services for “credit repair near me” or “software for credit repair,” you’ve come to the right place.

Here, we’ll walk you through some of the best software for credit repair software and credit repair service for “credit repair near me” as well.

Turbo Credit: Consumer Edition

Turbo Credit is the first to make into our list of credit repair software. The primary objective of Turbo Credit is to correct inaccurate information in your credit report and identify & prevent thefts.

Description Turbo Credit is a patent-pending software application intended to question and refute any negative things on a credit sheet. The Turbo Dispute Generator features Turbo Credit, creating conflict documentation in minutes for Transunion, Experian, and Equifax. Turbo Credit also provides Turbo Stop, an immersive software document that will legitimately avoid borrowers from harassing and annoying calls. Turbo Credit will help you get the most up-to-date and accurate credit report to increase and boost your credit scores.

The Turbo Credit Advantage: Allows American customers to comfort their own homes to handle their credit. The Turbo Credit scheme is a similar scheme used by financial, honor, and loan practitioners for their fee-based professional services. Millions of Americans use software programs to control their money, budget, and personal finances; Turbo Credit helps American consumers directly manage their credit.

Turbo Credit provides the resources that will benefit customers: reduce interest rates and get accepted for mortgage loans, auto loans, credit cards, etc., while getting the accurate credit report they need by statute. Question and refute deceptive and misleading records. Boost credit ratings by trying to eradicate incorrect and misleading information such as late fees, defaults, charge-offs, and convictions; Fighting identity fraud problems that surface on Turbo Credit credit reports makes the law work for you!

Before it is entered into credit records, details must be correct and checked! If the borrowers or credit rating agencies have not adequately followed appropriate protocols, all checked inaccuracies, as specified in the Equal Credit Reporting Act (FCRA), must be excluded from their credit records. Turbo Credit helps protect the interests of American consumers covered by the FCRA.

It’s a consumer edition from Turbo Credit. It works similar to financial & credit professionals’ systems for providing their services to people with a bad credit score.

The best thing about Turbo Credit is that you can use it as a tool for “do-it-yourself” credit repair. Around 79% of credit reports contain errors that result in a bad credit score. Even the slightest of mistakes can lead to a massive miscalculation and result in the loss of thousands of dollars.

Using its easy, simple, and proven system, you can maximize your credit score, which can help you get low-interest rates. Using Turbo Credit, you can identify and report fraudulent & false information.

Turbo credit repair software enables you to correct inaccurate & erroneous information such as late payments, charge-offs, and inquiries. All these benefits collectively help get up-to-date & accurate credit reports, ultimately improving your credit score.

One of the most significant advantages of Turbo Credit is its 30-day money-back guarantee, which makes it a safe investment. In case Turbo Credit software fails to perform and doesn’t live up to its claims, you can take back your money within 30 days.

700 Credit Repair

700 Credit Repair is the second to make into our best credit repair software and service providers list. It is a Texas-based credit repairing company. 700 Credit Repair claims to build & repair your credit by inquiring directly with major credit bureaus. 700 Credit Repair delivers standout performance with its automated technology.

With 700 Credit Repair Software, you get access to a wide range of credit repair tools that enable you to improve your credit score from a very low level to a higher level. Eventually, you can get your loans approved.700 Credit Repair is easy to use and lets you enroll easily & quickly. If you wish to consult with a certified credit counselor, 700 Credit Repair can do so. The best part is nothing to worry about in your dispute letters. 700 Credit Repair has lawyer-reviewed dispute letters that reduce the chances of getting your message marked as incorrect.

Another great advantage is that you’re not locked in a several months contracts. 700 Credit Repair uses a pay-as-you-go approach and charges you only for your services. The majority of services & software for credit repair either work for large enterprises or individuals; however, 700 Credit Repair is explicitly designed to assist small businesses.

Credit reporting laws are continually changing and are more complicated than ever. Credit repair has changed. The process that most businesses use today is a thing of the past.

The rating categories for credit reports have changed and continue to change over the years, as has the process. The process of using form letters to deal with negative accounts not only doesn’t work; it may not improve your score as well. Accurate and verifiable information cannot be deleted, but some companies claim that they do.

In everyday situations, deleting a seemingly negative account can lower your credit score, as other aspects of the account will improve your score. If your goal is to increase your score, you should know the categories that make up your FICO score.

Our fast and robust process is designed to increase your credit scores by as many points and as quickly as possible by verifying accounts’ accuracy through several advanced tactics. Our process includes both the direct credit bureau and creditor reviews.

They see remarkable results by denying and eliminating inaccurate, erroneous, misleading, outdated, and unverifiable negative accounts with credit bureaus and creditors. If you work directly with creditors to get letters of set-off or set-off, take advantage of all rating categories, and ensure you have the right number of accounts opened with perfect use, you won’t just see a change in your scores, but the quality of life as well.

700 Credit Repair software has a client portal where users can check the status of services, disputes, and improvements in their credit reports.

TurnScor

TurnScor is a helpful software for credit repair that primarily focuses on improving credit scores & educating its users about credit & finance management. It trains its users to get a more in-depth knowledge of financial management.

TurnScor is part of Advanced Credit Technologies that focuses on fraud detection & prevention and credit management. With TurnScor, you get various tools that help you manage & maintain a healthy credit score that depicts credit repair & management isn’t a one-time event.

TurnScor has an intuitive interface and is easy to use for both experts & novices. You can access the learning material to understand the credit repair process. TurnScor ensures that the creditors and & credit bureaus must correct any inaccurate information to make your credit report accurate and according to the Federal Credit Reporting Act.

When you use TurnScor, you get your most recent credit report from the top credit bureaus, identify credit items, send challenge letters to credit bureaus, and then update & improve your credit score.

One of the best things about TurnScor is its 60-day money-back guarantee. If it fails to satisfy, you can claim a refund, and TurnScor issues a refund with no questions.

TurnScor has a training center that provides a step-by-step guide to credit management. You get a variety of learning materials, including e-books and videos.

Credit Aid

Credit-Aid gives you access to inexpensive credit repair software that guarantees to improve your credit score. Otherwise, you can claim a 100% refund. Credit-Aid doesn’t only repair and strengthen your credit score but disputes bankruptcies as well. Credit-Aid is a California-based credit-improving company that provides credit repair software services. Although now it seems like they have shifted their business model to become more of a franchise where you can start your credit repair service. What’s better than fixing your credit score and starting a business simultaneously?

Credit-Aid is credible because of detailed information about its team on its website. Transparency is what makes it an authentic company.

Credit-Aid enables you to correct your credit report through a straightforward 3-step process. At the time of sign-up, you provide all the required details. After successful signup, you can order your credit reports from the major credit bureaus, review your credit report, and correct errors to update it & improve your credit score.

The process is perfectly streamlined, and ready-made challenge letter templates make the job easier. Credit-Aid lets you dispute as many credit items as you want and send it to each credit bureau for correction.

Before committing to any premium plan, you can avail of free demo software to test its services’ efficacy & accuracy. Credit-Aid has a resourceful education center on its website where you can learn the know-how of credit repair & credit management.

Credit Detailer

It is another software for credit repair & training on credit management. It enables its users to become better finance handlers and efficient at credit management. Credit Detailer is a New Hampshire-based credit repair company that provides credit repair software, not “credit repair services”.

It enables you to repair your Credit by “do-it-yourself” work. However, you get all the essential tools to efficiently complete your credit repair task at your own pace and right from the comfort of your house.

You can sign up to access the tools through an easy signup process. It provides you with multiple screens to enter the details of each creditor. You can manage all your credit accounts on the same platform. Before starting your credit repair process, you must select a reason to challenge your credit report. Then, choose one of the major credit bureaus where you want to dispute your credit report.

Credit Detailers enable you to choose from various challenging reasons, including collections, late payments, charge-offs, and bankruptcy. Credit Detailer lets you add as many credit accounts as you want because there’s no limitation on the number of credit accounts.

Another added advantage of Credit Detailer is that it collaborates with a credit repair firm, The Credit Coach. You can get live assistance to complete the credit repair process. It also trains you to manage your Credit effectively.

Credit Detailer lets you run the software on a 7-day trial basis. This allows you to test the efficacy of Credit Detailer.

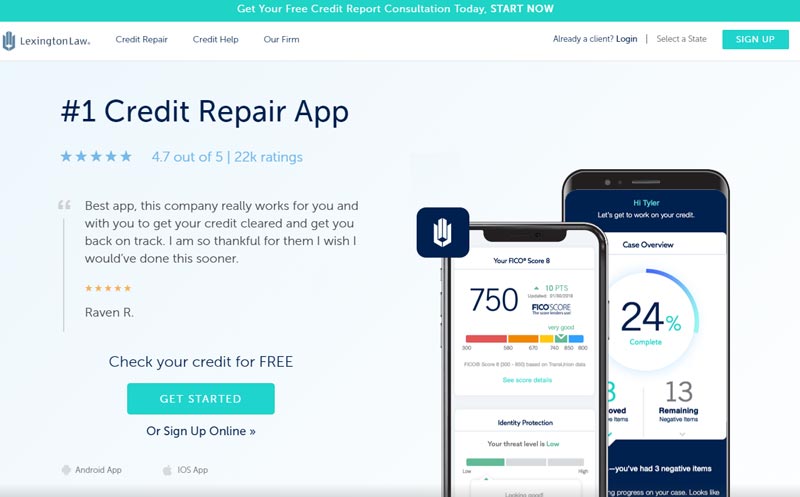

Lexington Law

If you are looking for the best credit repair services near me, then Lexington Law is the right choice. It is the most professional and skilled credit repair firm in the credit repair space. It boasts highly trained individuals and effective processes to heal wounded credit reports. It’s been working since 2004 and is the best credit repair software and service, provider.

The best part of hiring Lexington Law services is offering free initial consultation, making it easy to identify and set your objectives. The initial consultation lets you determine your current credit status and guides you about the best possible path you should follow.

Once you are done with the initial consultation and provide a summary report on your credit reports, Lexington Law asks you to provide your most recent credit reports. Lexington Law can fetch your credit reports from all three major credit bureaus on your part.

Lexington Law has the reputation of finding the most damaging items from the client’s credit reports. On average, it makes 10.2 negative items per client. Lexington Law identifies faulty credit items and files dispute letters. The more negative things present in your report, the more the chances of improving your credit score.

Lexington Law sends appropriate correspondence to your creditors & credit bureaus so they fix the simple mistakes and improve your credit score.

Lexington Law helps you eliminate credit mistakes, including collection, charge-offs, late payments, foreclosures, judgments, liens, and bankruptcies.

Credit Dispute Pros

Credit Dispute Pros is another excellent choice for repairing your credit. Credit Dispute Pros is a credit repair service provider. It helps you repair your credit report, eradicate inaccurate information, and improve your credit score, which ultimately helps you get all kinds of loans. The benefit of improved credit scores includes quick loan approval at low-interest rates and various others.

If your credit score is low and you can’t get a car, home, or business loan and want to improve your credit score, then you need to correct your credit report. Credit reports usually contain inaccurate information and false credit items that degrade your credit score.

You can repair your credit score by completing a simple enrollment form on the Credit Dispute Pros website. Then, you need to present a payment receipt, and Credit Dispute Pros will start to repair your credit score. They have a streamlined and effective credit repair process that guarantees healthy results. Credit Dispute Pros identify misinformation & inconsistencies in your reports because of your creditors. Then, they grab those opportunities and write challenge letters to major credit bureaus.

An added advantage of Credit Dispute Pros is credit counseling, which helps you manage your credit and maintain a good credit score.

The Credit Coach

It is one of the most suitable choices if you’re looking to find services for credit repair near me. The best thing about The Credit Coach is that it’s a beneficial credit repair service and helps you become better at credit management.

The Credit Coach offers a variety of plans where you can learn more in-depth knowledge of credit management and credit repair. The Credit Coach provides comprehensive credit management training and ongoing support as well. Even if you’ve finished your training period and still need some assistance, The Credit Coach is available to help you.

The Credit Coach is a brilliant choice for business owners who want to learn more in-depth knowledge and skills to repair & manage their credit accounts.

It also has a unique addition, where it tracks your credit. It automatically writes challenge letters to credit bureaus that enable you to keep up-to-date credit reports and better credit scores.

The Credit Coach provides high-quality credit management training and ongoing support. You help through various channels, including e-mails & newsletters, webinars, regular phone calls from your business coach, software services, and many others. It results in substantial profit margins, and you don’t need to hire credit management professionals to manage your credit accounts.

Credit Doctor Company

Credit Doctor Company is another efficient choice if you’re looking for a credit repair service near me. It offers the Credit Doctor Premium Plan where you get all kinds of credit repair-related services. It provides flexible services based on your business and the type of credit inconsistencies you focus on repairing.

It offers various credit-related plans, including Credit Management, Credit Repair, and Debt Negotiation. The variety of plans and credit services make it stand out. If you’re looking to file unlimited disputes, resolve debt violations, and cease & desist collectors from calling you, then Credit Doctor Premium Plan is an ideal choice.

When you sign up for its services, you must provide all the details regarding your creditors. Credit Doctor Company collects your credit reports from your creditors and the major credit bureaus. Credit Doctor Company files challenge letters to all the three major credit bureaus after identifying the irregularities and inaccurate information in your credit reports. Credit Doctor Company monitors the progress of your credit score regularly.

In case you want to inspect challenge letters and documents, you can access them through iSEEYOU portal.

One of the best things about its services is that the plans are flexible and affordable. Some credit repair services charge considerable money and lock you in several months’ contracts. However, Credit Doctor Company offers ease of use and affordability.

Credit Repair Magic

Credit Repair Magic is an efficient credit repair service in the credit repair space that guarantees effectiveness, accuracy, value, and speed.

Credit Repair Magic works on a self-directed approach and uses automation to identify credit mistakes and prepare challenge letters. Credit Repair Magic claims to use the most effective bad credit eliminator approach. It generates automated disputes based on the negative items in your credit reports. The automated process also includes a performance tracker that keeps track of the process and sends automatic reminders based on your credit repair process’s status.

Credit Repair Magic offers competitive market rates and lets you save a few bucks. You also get access to a credit expert program that educates you about credit management.

Are Credit Repair Companies Effective?

Credit repair companies only work when you put in the effort. To make these options work, you must invest time. They won’t help if you ignore your credit repair goals or let them slide. Most will send reminders, but not all of them!

You could go to the Consumer Financial Protection Bureau’s (CFPB) website and read the how-to guides, but why would you want to? You already have the tools, and some of them are completely free.

Repairing your credit requires patience. Credit repair companies take at most four to six months to show a significant improvement in credit scores. If your credit reports are more complicated, it might take longer.

It is difficult to predict which disputes will be accepted or rejected. Credit repair businesses cannot promise results. You’ll better understand credit if they follow the Credit Repair Organizations Act (CROA) rules.

The best credit repair company will have the pricing and interface you need to help you with your credit score. Make a list of everything you need in a credit repair agency.

Many credit repair programs can help you fix your credit score or create your credit repair agency.

What is Credit Repair Software?

Credit repair software provides tools and resources to help clients, and you fix your credit.

These software packages help you identify credit issues and fix them.

One of the most popular ways to repair credit is by submitting disputes to credit bureaus. For example, you can file disputes regarding late payments, collections, or other credit problems.

Credit repair software includes letter templates and auto-filled letters to help with disputes. It also assists in filing and tracking disputes.

Credit repair software is not the same as credit repair services. Credit repair services provide one-on-one guidance and coaching. They are regulated under the Credit Repair Organization Act (CROA).

Here are some things to consider when shopping for credit repair software

When shopping for credit repair software, remember that credit repair software does not include credit-repair services.

Credit repair services are governed under the Credit Repair Organizations Act. This regulates how credit repair companies can operate. These include advising you about your rights and not making false promises. In addition, you will not be charged until the services are completed.

These laws don’t apply to personal credit repair software. They can charge you upfront for software. It is up to the consumer to understand their rights.

Another thing to remember about credit repair software is that you can complete all the processes it offers for free. Therefore, software should save you time and be useful. It is therefore important to assess the software in this way.

Software packages that are not integrated into your credit reports, for example, will require you to enter the accounts you are disputing and all details manually.

Compare the plans offered by credit repair software providers. Make sure you consider your personal needs. A premium plan might not be worth the extra cost if your credit problems are simple.

You are a credit repair company looking for software. Here are your key questions to ask when you shop.

- What number of clients does it serve?

- What number of team members does it support

- Is there a storage limit?

- Are there additional services I may need (e.g., marketing tools)

Many business credit repair software programs are meant to keep client records and file disputes. Others, however, offer more comprehensive credit repair tools than just filing disputes.

How to Choose the Best Credit Repair Software

We looked at a few criteria when comparing the five credit repair software options. These criteria helped narrow down the differences between software packages from these five companies.

Here is a summary and explanation of the criteria we used when comparing software packages.

Best for Feature

What is the best credit repair software?

Although this is a subjective criterion, we used the general features of each software package as a guideline to help us determine which users it was best suited for.

Service Type

There are two major markets for credit repair software: individual (individual) and business. Many companies offer either one or both, though some offer both.

Software packages can be offered to individuals or businesses by companies, but it’s still possible that one package is better than the others.

Value and Cost

While price is important when looking for a product/service, value is just as important.

Although the price of credit repair software may vary, all three options offer a value comparable to their price.

Credit Repair Cloud, for example, has a high monthly cost but comes with many features to support businesses from their inception through expansion.

Hands Off Versus Hands-On

Are you looking for a quick and easy solution to your credit repair problems?

In evaluating credit card integration, this is what we want to answer. Software packages that integrate with credit report integration allow customers to find and dispute information quickly.

Software packages that do not allow integration with credit reports will require you to enter data manually and better understand the dispute process.

Additional Charges

Some of the software options in our list are simple to price. For example, you can choose from a flat fee or limited subscription options.

Other software companies on this list also offer complicated pricing options, including multiple subscriptions or optional add-on services. These options can be customized for your software package but can lead to additional costs.

We felt it was important to include the potential budget-killers and the cost of the software.

Coaching Services

Credit repair software is not the same as credit repair services if you have one-on-one contact with an expert.

A few software companies also offer credit coaching services. This is more than just technical support and can help you use the software to its full potential.

Supported

Credit repair business owners need to know how many clients the software can handle. Is the software able to grow with you?

These business software options offer unlimited clients or packages with increasing maximum client counts. They are here to help you grow.

Final Words On Choosing Credit Repair Software

No service & software for credit repair in the credit repair space is the same and delivers the same quality results. However, the services & software included in the list above are top-performing.

As you can see, credit repair software is an excellent way to improve your credit score, but the results may vary. For the people that want more control over the credit repair process and maybe do not feel comfortable hiring a team of professionals, using credit repair software will be the best option.

It is your credit score at the end of the day and turning to either a professional or signing up for one of the software programs we reviewed today to maximize your results and increase your chances of success.

If you are curious to see what other guides we have provided on our website, you can look here at our Guides section.