Leeloo Trader Funding Review

Transparency: If you click on the links on this page, we might get compensated. See our full affiliate disclosure here.

Disclaimer: This article is written for informational or entertainment purposes only. It is based on our opinion formed through our own experience, research, and testing of our team. While we might get compensated from link clicks on this page, the compensation does not affect how we rate them. The authors of LegitVerified are not certified financial professionals. You should consult a financial professional before making financial decisions.

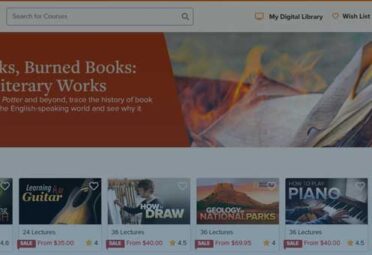

Is Leeloo a good choice for trading? This Leeloo trader funding review covers the basics: Trading education, platform, Minimum capital requirement, and Trailing drawdown. The company is still in the early stages of development. If you’re looking for a trading platform, you might want to try a free trial before committing. In addition, you’ll want to make sure that the company is honest and trustworthy before committing to a long-term plan.

Trading education

Traders have a few options for Leeloo trader funding. The performance account is one of the least expensive options, but it requires you to be in business for ten trading days before Leeloo will fund your account. In addition, this option isn’t as easy as other platforms as it is recommended to avoid US holidays, although you can make exceptions for Good Friday. The performance account is available for trading CME, COMEX, and CBOT.

The website of Leeloo Trading is rather unprofessional for a financial institution. As a result, traders may have difficulty believing it is a legitimate futures trading program. The company’s Youtube videos were also bizarre, with ranches, bulls, and horses. But, despite the company’s unprofessional appearance, the platform has proven to be a 100% reliable funded futures trading program.

Traders who wish to apply for funding must pass a rigorous assessment process. First, they are required to demonstrate their skills and demonstrate that they can manage their funds. Then, they must pass a trading test and challenge. This is the most important component in developing consistent success in the market. Traders who pass the assessment process should be able to operate with a wide range of approaches. These include trading with a broader macro view of the market.

In this Leeloo trader funding review, I’ll cover the main benefits of this program. First, the company offers good conditions for funding. The company is willing to pay up to 80% of your profits as long as you meet their requirements. In addition, Leeloo offers a guaranteed payout policy. Finally, the company has a track record of timely payouts, which is a huge plus.

Trading platform

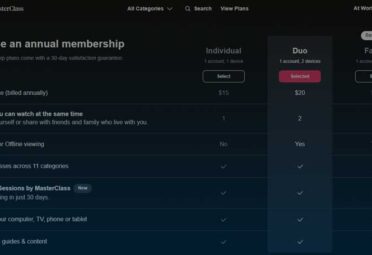

After reading the Leeloo trader funding review, you probably want to get started on this platform. First, it would help if you kept in mind that Leeloo does not offer a glide account. In addition, Leeloo calculates its drawdown using unrealized profits, making it more difficult for swing traders to avoid a static drawdown. However, if you are willing to adjust your trading style and risk appetite, you can reap the benefits of a static drawdown.

One advantage of Leeloo is its high available leverage, although using too much leverage poses high risks. Additionally, the system is easy to use and offers a single step to funding. Traders can also choose from several types of accounts, including those designed for overnight trading. There are three main types of accounts: a limited number of funds and unlimited trading. In addition, a trader can choose either the Accelerator or the Investor option, which gives them the freedom to trade up to 3 mini contracts overnight.

The founders of Leeloo Trading are 3rd-generation ranchers and farmers who have launched successful projects in Montana. While the firm does not invest its own money, it pays up to 80% of profits and all losses to a proprietary firm. The rules and prices offered by Leeloo are reasonable for the most part. If you can make a profit with it, you’ll be on your way to success!

Leeloo Trading has a growing presence in the futures trading industry, and the company is dedicated to helping budding traders find their way. The fees are affordable, and new traders’ conditions are easy to follow. In addition, there are no trading time restrictions and no scaling plan, so Leeloo will reset your account for a very low cost even if your trading style changes. However, despite its low fees and easy conditions, many people still wonder about the legitimacy of Leeloo Trading and if it is a scam.

Trailing drawdown

Whether or not you choose a trailing drawdown account is crucial when evaluating a funded trading program. Generally, trailing drawdowns are calculated intraday and will not move until you reach your profit target. This rule has several unique characteristics and is often the most important aspect of a funded trading program. Here is a look at how Leeloo calculates its trailing drawdown.

Before qualifying for a trailing drawdown account with Leeloo, you must first send them a full extract of your trading activity in Rhitmic’s R Trader software. Once you’ve submitted a sample of trades, Leeloo will verify your account and send you an email. In some cases, you will receive a certificate in the mail.

If you’re using a $50k trading account with a $2,000 trailing drawdown, the trailing drawdown is $2,000, even if you have a $48,000 minimum balance. If you don’t close your account, the trailing drawdown stops once you reach your initial balance plus $100. But, there’s another way to avoid this: using an Accelerator option to trade, for example. If you’re going for a faster trailing drawdown, try using Topstep’s Trading Combine. Earn2Trade also has a similar feature, which calculates the trailing drawdown at the end of the day.

Another option is the Natural Trading Funded Trader Program. This program helps traders achieve their profit target and gets funded based on their performance. With a free 10-day trial period, you can try Leeloo and see if it meets your trading needs. You’ll be glad you did. Then, please take advantage of its trailing drawdown to make the most of your trading capital.

Minimum capital requirements

As a new trader, you’ll want to know how much you need to fund your account before you can trade. Leeloo is one of the newest providers of funded trading accounts. Their small team includes three brothers and sisters proud of their traditional values. This can help you stay disciplined and make a profit even when you’re new to the market. If you’re worried about how much capital to invest, consider using a demo account first to see how much it can be.

After you’ve signed up, you’ll be required to deposit $85 to open a demo account. This account can only be used for demo trading until you earn $85 in profits. Once you’re on the platform, you’ll need to follow the guidelines to continue trading. Fortunately, Leeloo’s evaluation process is surprisingly easy. Just ensure you follow all the guidelines, and you’ll be on your way to becoming a successful trader.

Once you have enough money to open an account, you’ll need to decide how much you will invest in the marketplace. Leeloo has a surprisingly low minimum capital requirement. As a result, most traders don’t need to deposit much money initially, and they can begin trading with as little as $1,000. If you don’t feel comfortable investing this much money, though, you can opt to start with a smaller account and see how you do.

Although the minimum account capital requirements for the two competing programs are higher, Leeloo Trading doesn’t have a consistent minimum. Traders should know this and plan on using a demo account for a few months before using it full-time. In addition, while other trading platforms require a minimum of $50k to open a demo account, Leeloo allows traders to trade up to eight contracts in their account without a minimum reset fee. This means you can start trading less capital and making more money.

Founders

In this Leeloo Trader founders funding review, we’ll discuss the business model and values of this fast-growing trader funding company. The company’s founders are third-generation farmers and ranchers. Their combined experience in farming and business operations is extensive, and they share a deep commitment to the community. As a result, they’ve launched various successful projects in the Montana area.

Initially, Leeloo Trader began as a one-off design for a family member. From there, it grew into a full-fledged business. The founders of Leeloo trader now divide their time between the company and school. They’ve even been invited to participate in a trade show, the One of a Kind trade show, for several years. The experience has been rewarding and exciting.

The company’s video commercials are not related to Funded accounts and are a marketing strategy to spread the word faster. However, many YouTubers have mentioned the company on their channels and even commented on it as a scam. The company pays traders every time. This Leeloo Trader founders’ funding review highlights the pros and cons of the program and the business model itself.