FTMO Review: Is FTMO For You?

Transparency: If you click on the links on this page, we might get compensated. See our full affiliate disclosure here.

Disclaimer: This article is written for informational or entertainment purposes only. It is based on our opinion formed through our own experience, research, and testing of our team. While we might get compensated from link clicks on this page, the compensation does not affect how we rate them. The authors of LegitVerified are not certified financial professionals. You should consult a financial professional before making financial decisions.

FTMO is a forex prop trading firm that offers a profit split of 80/20 and a trading challenge. In addition, it charges no commissions on withdrawals. Here are some of the benefits of FTMO. If you are new to forex trading, you should read this review before signing up. It has been around for a few years and has helped traders worldwide earn big profits. This review will help you decide whether it is for you.

FTMO is a forex prop trading firm

FTMO was founded in 2014 and has quickly expanded its operations worldwide, registering traders in more than 180 countries and processing more than six million daily trades. It has won the Deloitte Technology Fast 50 award for three consecutive years and has even been featured in Forbes. Although its service is similar to a broker’s, FTMO offers higher profit shares and a unique trading model. The company requires traders to prove their trading skills before they are accepted into the program.

The most common reason traders fail is undercapitalization and a lack of experience. A forex prop trading firm can help you make the financial decisions you need, such as whether or not to pursue trading as a full-time career. FTMO’s flexible application process allows applicants to earn bonuses and bypass the line once they have enough experience. During the two-phase evaluation process, applicants must hit a profit target of 5% or 8%. Applicants with enough experience can skip the line and qualify for free extensions. In addition, FTMO allows unlimited free retakes, so applicants can avoid the process entirely if necessary.

FTMO is a leading forex prop trading firm that provides traders up to $2 million in trading capital. The company seeks out profitable traders and supports them every step. Its two-step evaluation process verifies the forex trader’s skills and qualifications. Once the evaluation process is completed, the traders can invest professionally with a forex prop trading firm and funded accounts. As a result, traders can trade as much as $2 million in their accounts at leverages of one to one hundred and twenty.

It offers a trading challenge.

For people who are confident about their trading skills, Tradenet offers a trading challenge that lets them test themselves against other traders and compete for prizes. There are rules to follow, and participation should be taken seriously. This Challenge intends to identify top traders and push them to their limits. Winning it will allow you to open a funded trader account. Traders with little or no trading experience are often rejected. It is designed for high-potential, experienced traders.

The CME Group hosts three types of trading challenges. Each one has specific rules, and the participants can choose to participate in a trading competition hosted by a firm, professor, or individual. The trading challenges are designed to be risk-free and provide a competitive environment. Participants receive a virtual account valued at USD 100,000 and monitor their progress against other participants through a leaderboard. In addition, each trade is accompanied by a margin, which must be exceeded to make a profit.

To enter the Challenge, students must join a team of three to five fellow college or university students. Each team must elect a student leader. Teams can be student-led or faculty-led. Advisors can register early, but they cannot participate. During the competition, participants get a chance to meet with Bloomberg thought leaders. Afterward, they can apply for internships with Bloomberg to learn from the best. They can participate in Bloomberg’s Trading Challenge if they meet the eligibility requirements.

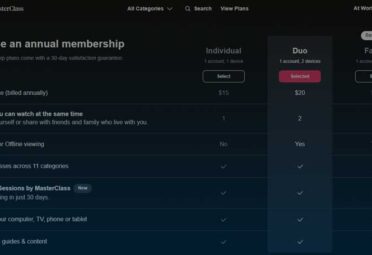

It offers a profit split of 80/20

Companies face two main challenges when pricing their products: figuring out the right price point and ensuring that all customers are getting the same value. Unfortunately, most businesses treat all customers similarly and don’t analyze pricing based on value. The result is that a small percentage of customers will have higher prices than the other 80%. This mistake can be avoided by following the 80/20 profit split.

An 80/20 company will change its entire structure and priorities to focus on the most valuable relationships. Restructuring sales, compensation, manufacturing, distribution, and billing will take some time but will pay off in the long run. Because the 80/20 principle is more about relationships than cost cutting, the shift will require time, effort, and money. However, companies must commit to this new process to reap the benefits. This is the way to go if you want to see a substantial change in your company.

It charges no commissions for withdrawals.

FTMO charges no commissions for withdrawals. To withdraw your earnings, you invoice FTMO, and they will send you the money by Skrill or a regular bank transfer. You can invoice FTMO as an individual or as a company. It is important to note that you should handle your earnings by the local tax regulations. Consult with a tax advisor in your country for more information.

FTMO does not allow users to lose more than 5000 dollars daily, requiring you to pay a commission of 610 dollars. This would be almost a sure way to lose your money. Instead, you can practice using the demo account for free. It allows you to practice on a simulator before transferring your funds to a real account. The demo account will allow you to get a feel for the platform and help you decide whether or not it is right for you.

FTMO presents itself as a money management company and not a broker in the traditional sense. Instead, they help professional traders by finding them and transferring their funds to them. The traders use the funds to trade Forex assets. These traders make about 6 million trades on real investment accounts. Since FTMO pays 70-30% of profits to traders, the conditions are hard-testing and attractive for the real trader.

It offers a trading journal.

If you have ever traded, you know the value of a trading journal. Keeping a trading journal can help you identify your market strengths and weaknesses and be useful for your long-term trading strategy. As the market is constantly changing, educating yourself and remaining consistent is imperative. In addition to tracking your trades, you can also make observations about the market and turn them into an edge. With a trading journal, you can make more informed decisions and stay on track of your trades.

A trading journal contains records in chronological order. Each record represents a trade and includes the entry and exit prices, position size, direction, and other relevant data. When possible, you should record the outcome of each trade and the amount of money gained or lost. This information is important for evaluating the value of a successful trade. It also highlights areas of improvement. Keeping a trading journal is crucial for your long-term profitability.

Keeping a trading journal allows you to experiment with different strategies and stick with the ones that work. It also allows you to develop new trading systems, resulting in higher profits quickly. It is also helpful in risk management. In addition to using a trading journal to improve your long-term trading strategy, it helps you learn to assess your level of risk. And remember, the best trading journal should be inexpensive. It should also be easy to use.